We are in the midst of a great revolution in the payments space: anyone with a phone can now accept credit cards; online-to-offline commerce is allowing online payment for offline purchase and significant friction is being removed from the consumer purchase experience thanks to mobile. All of this innovation (read: competition), combined with government intervention, means that payment fees are falling, threatening revenue streams for incumbents and startups alike in the payments space. But a broader opportunity exists: using the data of payments to build a more valuable, more defensible business model, one not dependent on fees. The result will revolutionize offline commerce and online advertising.

Today: It’s All About Fees, and They’re Heading Towards Zero

Payment companies make money by charging fees to “process” a payment from buyer to seller. Square charges 2.75% (or $275/month for volume up to $250K/year). PayPal Here charges 2.7%, as does Intuit GoPayment. Groupon and Amazon are both supposedly working on their own dongles, and prices will continue to fall, especially as these new devices create “one-sided” networks without significant defensibility outside of switching cost and inertia. “Pay with Square” is a potential game changer, as the millions of Square user accounts can ONLY be used with Square. But basic “acceptance of credit cards” is becoming a commodity where prices will keep going down.

Competition between payment companies is only one leg of inevitable downward pricing pressure. Government intervention is the other. Not too long ago, the Australian government decided that payment fees were too high, so now most Australian merchants pay less than .5% for credit card swipes, a fraction of the cost here in the US. The European Union is likely to enact similar legislation. The Durbin Amendment of Dodd-Frank and the $6B+ (pending) Brooklyn Settlement are US-based government and civil attacks on the business of payment fees. Many of these fee-cutting regulations help intermediaries like PayPal and Square short term, by reducing their cost (owed to the Visa/MasterCard infrastructure), but eventually it limits what they can charge, too.

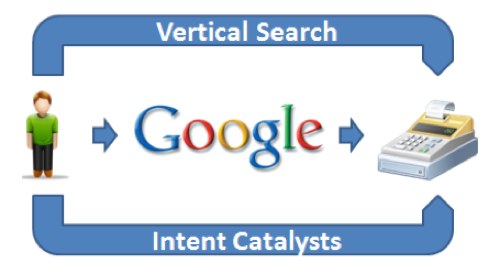

Wherever fees end up, most merchants will still dislike paying them. They are a “cost of doing business” that every merchant has an incentive to bring down. Payment companies generally aren’t delivering new customers; they’re taxing the flow of existing ones. Google effectively charges 20-30% to deliver a customer (if you back out the cost-per-click to percentage of realized sale) to an ecommerce merchant, yet merchants are competing to hand Google more money because each dollar “in” produces more than a dollar “out.” Payment companies charge a fraction of Google, but are often despised (witness the lawsuits and legislation) or treated with promiscuous disrespect.

It comes down to something rather simple: Connecting the bank accounts of buyers and sellers will never be as valuable nor defensible as connecting buyers and sellers. Google delivers customers at the top of the funnel, and payment companies serve the prosaic, but necessary, task of shuffling funds at the end.

Tomorrow: Payment Data Will Revolutionize Commerce & Advertising

As society goes increasingly cashless, payment companies will have a larger business, and a more valuable one, in closing the loop for offline transactions and helping deliver customers. The data they possess is without equal; did somebody buy something? How much did he spend? What did she buy? Paper money cannot be tracked in this manner. In order for Online-to-Offline commerce to take flight, every merchant needs an ability to track online/mobile action to offline purchase, and PayPal Here, Square, GoPayment and others could provide just this for a whole new class of small merchants.

Imagine that Wendy’s, or even a local handyman, wants to advertise on the Internet. What’s the point? What does a click, or an impression, really mean? It’s clear what it means online, since every click can be measured to “action” (e.g., purchase) for an ecommerce company. Who can tell Wendy’s, or the local handyman, if that online advertisement worked?

In an increasingly cashless society, the answer is pretty clear: the payment infrastructure. Tracking that purchase back to the originating source (Google? Yelp? Patch? etc) is known as “closing the loop” and will revolutionize offline commerce and advertising alike.

The million-plus merchants walking around with Square, PayPal Here, and GoPayment dongles want more customers, and these dongles provide a means to “close the loop” and let those merchants acquire more customers, remarket to those customers, understand those customers, and do everything that ecommerce companies have taken for granted for over a decade. Legacy POS systems were poorly integrated and insufficiently verticalized, often requiring a merchant to have separate relationships with every player in the payment chain (hardware vendor, merchant bank, CRM system, etc); moreover, they were priced out of reach of the sole proprietor.

Beyond closing the loop, payment companies can utilize data from existing transactions to generate more transactions. Companies who maintain a direct relationship with the consumer — such as American Express, PayPal, Square, Discover, etc — are in the perfect position to serve as an Amazon recommendation system for “everything.” You bought a tennis racket at Sports Authority? How about tennis lessons with Saul the tennis pro, at a discount thanks to your purchase of a tennis racket, only redeemable with the same payment instrument? You weren’t searching for Saul, and you wouldn’t want an unsolicited email from Saul, but seeing an advertisement for Saul shortly after buying a tennis racket (say, on your purchase receipt) would likely produce a response. It’s a way topreeempt search for a large class of “secondary” purchases (e.g., charcoal after buying a grill; tennis balls after buying a tennis racket, etc), in a “pull” based way.

None of this is to say that the fees charged today are wholly unreasonable and unconscionable; they’re just not long-term defensible as more parties offer the same conduits to existing credit card infrastructure. I have $40 cash and five credit cards in my wallet right now, so any merchant wanting to charge $100 for some widget can either get 97.25% of $100 (if using Square), or $0. That’s an easy decision and shows why things like Square and PayPal Here are hugely beneficial to merchants and consumers alike. But longer term, as those fees continue to compress to the benefit of merchants, the larger business will be in applying the data of payments to the benefit of merchants, consumers, and payment providers alike.